Loading

Get Canada Rc232 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC232 online

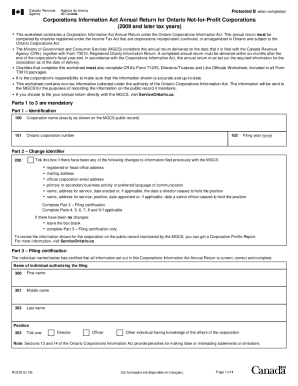

The Canada RC232 form serves as the Corporations Information Act Annual Return for Ontario Not-for-Profit Corporations. This guide will provide you with a clear and structured approach to completing this form online, ensuring accurate and timely submissions.

Follow the steps to successfully complete the Canada RC232 form online.

- Press the ‘Get Form’ button to access the Canada RC232 online form and open it in your preferred editor.

- In Part 1, enter your corporation name exactly as it appears on the Ministry of Government and Consumer Services public record. Next, input your Ontario corporation number and your filing year in the designated fields.

- Move to Part 2 to indicate any changes. If applicable, tick the box provided to note changes to your registered or head office address, mailing address, or director information. If no changes exist, leave the box blank and proceed to Part 3.

- Complete Part 3 by providing the name of the individual authorizing the filing, including their first name, middle name, last name, and position within the corporation. Ensure to select the appropriate role from the options provided.

- If there were changes in Part 2, proceed to Parts 4 through 9 to provide updated information regarding addresses, email, business activities, and director/officer details as necessary.

- In Part 4, enter the new registered or head office address, if there is an update. Double-check to ensure that the provided address does not include a post office box.

- In Part 5, indicate if your corporation's mailing address differs from the registered office. Fill out the complete mailing address if it varies.

- For Part 6, enter any new official corporation email address.

- In Part 7, provide details for any alterations regarding business activities and select the preferred language for communication.

- In Part 8, input the contact details for the person to be reached about this filing.

- Finally, fill out Part 9 with the necessary information for directors or up to five senior officers. Ensure that all relevant details, including names and addresses, are accurate and complete.

- Review all entered information to ensure correctness, then save your changes. You can download, print, or share the form as needed.

Start filling out your Canada RC232 form online today for a smooth filing experience.

Related links form

Filing an Annual Return is a corporate law requirement. ... Foreign corporations with a licence endorsed under the Extra-Provincial Corporations Act to carry on business in Ontario must also file an Annual Return. Even small businesses not conducting business must file an Annual Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.