Loading

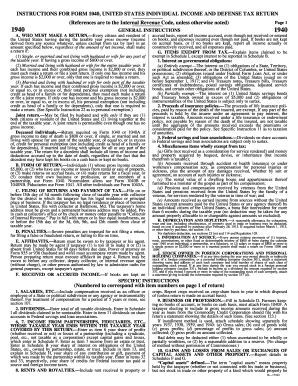

Get Form 1940

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1940 online

Filling out the Form 1940 can seem daunting, but with the right guidance, the process can be streamlined and efficient. This guide will provide you with clear instructions on how to successfully complete the form online.

Follow the steps to complete the Form 1940 effortlessly.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin with your personal information. Fill in your name, address, and social security number at the top of the form. Ensure that your details are accurately entered to avoid any processing delays.

- Indicate your filing status. Select from options like 'Single,' 'Married Filing Jointly,' or 'Head of Household' based on your situation. Each status will have different implications on your tax responsibility.

- Report your income by filling in all relevant fields. This includes salaries, dividends, and any other sources of income. Refer to appropriate schedules if necessary to ensure all income is appropriately documented.

- Deduct eligible expenses. Ensure that you enter any deductions you qualify for, such as educational expenses or charitable contributions, in the designated sections.

- Review additional sections for credits you may qualify for. This includes the earned income credit and other tax credits that may reduce your overall tax liability.

- Complete the tax computation section. Add up all your taxable income and apply the corresponding tax rates to determine your tax obligations.

- Finalize your form. After ensuring all information is accurate, save your changes before you download or print the completed Form 1940 for submission. You can also share it via email if necessary.

Ensure your tax documents are accurately filled out by completing the Form 1940 online today.

It has larger text and less shading than the regular 1040 to help older folks whose vision isn't what it used to be. The 1040-SR also includes a senior-specific standard deduction chart on a separate page.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.