Loading

Get 209b Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 209b Form online

Completing the 209b Form online is a straightforward process that can be accomplished efficiently with the right guidance. This guide provides step-by-step instructions to help users navigate each section of the form with confidence.

Follow the steps to complete the 209b Form online accurately.

- Click 'Get Form' button to access the 209b Form and open it for editing.

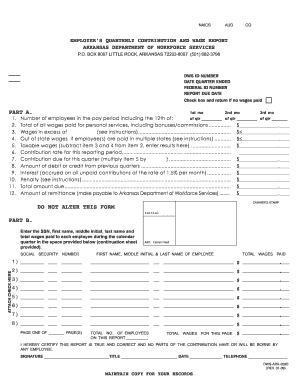

- Begin by entering your DWS ID number, federal ID number, and the due date for the report in the designated fields at the top of the form. Ensure this information is accurate to avoid processing delays.

- For each month in the quarter, provide the number of employees working, including the 12th of each month. Fill this information in the specific boxes corresponding to each month.

- Calculate the total wages paid for personal services, including any bonuses or commissions, and enter this amount in the designated field. This total should accurately reflect all wages for the quarter.

- In the next section, report any wages that exceed the limit specified in the form’s instructions. Enter this figure in the appropriate box.

- If applicable, indicate the total out-of-state wages if any employees have worked in multiple states during the quarter.

- Determine your taxable wages by subtracting the amounts from the prior two steps from the total wages reported. Record the resulting figure in the specified field.

- Enter the contribution rate for the reporting period in the corresponding box, which impacts your total contribution due.

- Calculate the contribution due for this quarter by multiplying the taxable wages by the contribution rate, then enter this amount in the appropriate field.

- If there is any debit or credit from previous quarters, input that amount next to the corresponding label.

- Include any interest accrued on unpaid contributions at the rate of 1.5% per month in the specified area.

- If any penalties apply as described in the form instructions, enter that amount.

- Finally, calculate the total amount due by summing all amounts, and enter this value in the designated field.

- Verify that all fields have been completed accurately, then proceed to save your changes, download the form, print it for your records, or share it as needed.

Complete your 209b Form online today to ensure timely filing and compliance with reporting requirements.

To file a weekly claim or to check the status of your claim, please visit ArkNet, Arkansas' continued claim filing system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.