Loading

Get Form 8821

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8821 online

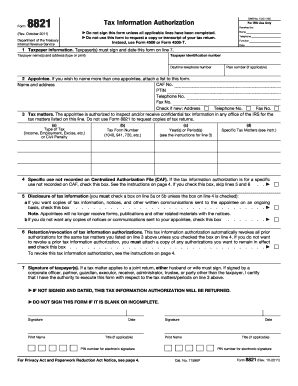

Filling out Form 8821, Tax Information Authorization, is an essential step for designating an appointee to access your confidential tax information. This guide will provide you with clear, step-by-step instructions on how to complete the form online.

Follow the steps to complete Form 8821 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In section 1, provide the taxpayer information, including taxpayer identification number, names, address, and a daytime telephone number. Ensure all details are accurate and clearly printed.

- In section 2, list the appointee details. Include their CAF number, name, address, PTIN, and telephone number. If you're naming multiple appointees, attach a separate list.

- In section 3, specify the tax matters. Include the type of tax, tax form number, years or periods, and any specific tax matters you want the appointee to address.

- In section 4, check if this authorization is for a specific use not recorded on the Centralized Authorization File (CAF). If applicable, skip lines 5 and 6.

- In section 5, disclose how you want tax information communicated. Check box 5a if you want ongoing copies sent to the appointee, or box 5b if no copies are needed.

- In section 6, indicate if you want to retain previous authorizations. If yes, attach copies of those authorizations.

- In section 7, both taxpayers must sign and date the form. If it's a joint return, ensure each partner has completed a separate Form 8821.

- Once all sections are complete and signed, you can save changes, download, print, or share the form as needed. Ensure it is submitted to the correct IRS office.

Complete your Form 8821 online to authorize your appointee easily and efficiently.

IRS Form 8821, Tax Information Authorization, allows you certain access to your client's information. In that way, it is similar to a power of attorney but grants less authority. The biggest difference between Form 2848 and Form 8821 is that the latter does not allow you to represent your client to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.