Loading

Get Firs Vat Form 002 Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Firs Vat Form 002 Pdf online

This guide provides comprehensive instructions on filling out the Firs Vat Form 002 Pdf online. By following these steps, you can complete the form accurately and efficiently, ensuring compliance with the relevant tax regulations.

Follow the steps to complete the Firs Vat Form 002 Pdf online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

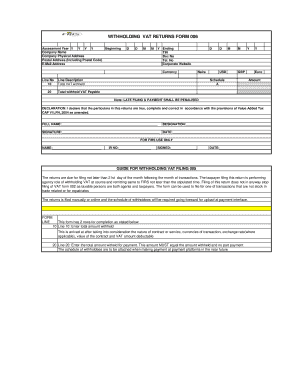

- Enter the assessment year in the designated field to indicate the tax period for which you are filing.

- Provide your company name in the section allocated for company details.

- Fill in your company’s physical address, ensuring that you include street details, city, and state.

- Enter your postal address, including the postal code, in the appropriate field.

- Input your email address, which will be used for communication regarding the return.

- Fill in the tax identification number (TIN) in the relevant section.

- Provide your phone number to ensure that the tax authority can reach you, if necessary.

- Complete the currency field by selecting the currency applicable to your transactions.

- On line 10, enter the total VAT withheld for the reporting period, based on the calculations provided in your records.

- On line 20, enter the total amount withheld for payment, ensuring that this matches the amount reported on line 10.

- Review the declaration section, affirming the accuracy of the provided information.

- Sign and date the form in the designated fields to validate your submission.

- After filling in all required fields, save changes to the form, then download or print it for submission.

Complete your documents online today to ensure timely tax compliance.

A VAT Return is a form you fill in to tell HM Revenue and Customs ( HMRC ) how much VAT you've charged and how much you've paid to other businesses. You usually need to send a VAT Return to HMRC every 3 months. This is known as your 'accounting period'.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.