Loading

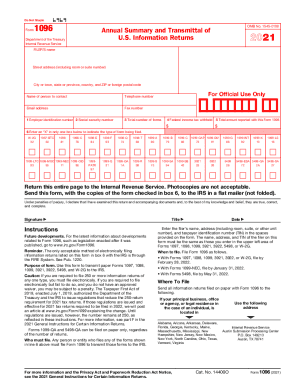

Get 2020 Form 1096 - Internal Revenue Service2020 Form 1096 - Internal Revenue Service2020 Form 1096

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2020 Form 1096 - Internal Revenue Service online

The 2020 Form 1096 serves as the annual summary and transmittal of various U.S. information returns to the Internal Revenue Service. This guide will provide clear and supportive steps to assist you in completing this form online accurately and efficiently.

Follow the steps to complete Form 1096 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the filer’s name, street address, city or town, state or province, and ZIP or foreign postal code in the designated fields.

- Provide the name of the person to contact, along with their telephone number, email address, and fax number, as required.

- In box 1 or box 2, input either your Employer Identification Number (EIN) or your Social Security Number (SSN). Ensure only one is completed based on your filing status.

- In box 3, indicate the total number of forms you are transmitting with Form 1096. Count only the correctly completed forms.

- In box 4, enter the total federal income tax withheld from the forms being submitted.

- In box 5, if applicable, enter the total amounts reported with this Form 1096; this step does not apply if filing Form 1098-T, 1099-A, or 1099-G.

- Choose the type of form you are filing by entering an 'X' in only one of the boxes presented in section six.

- Review your entries carefully to ensure all information is complete and accurate.

- Once completed, save your changes, and consider downloading, printing, or sharing the form as necessary.

Get started with completing your Form 1096 online today, ensuring your information is accurately transmitted to the IRS.

Since the IRS considers any 1099 payment as taxable income, you are required to report your 1099 payment on your tax return. For example, if you earned less than $600 as an independent contractor, the payer does not have to send you a 1099-MISC, but you still have to report the amount as self-employment income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.