Loading

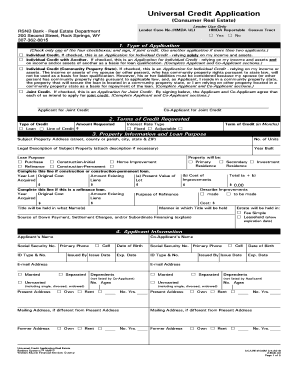

Get Credit Application. Universal Credit Application For Real Estate Without Ecoa Gmi Or Hmda Data

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Credit Application: Universal Credit Application for Real Estate Without ECOA GMI or HMDA Data online

This guide provides a comprehensive overview of the Universal Credit Application for Real Estate without ECOA GMI or HMDA data. It is designed to help users navigate the process of completing and submitting the credit application online with clarity and ease.

Follow the steps to successfully complete your credit application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the type of application you are submitting by checking one of the four boxes provided in the 'Type of Application' section. Specify whether the application is for Individual Credit, Individual Credit with Another, Individual Credit (Community Property State), or Joint Credit.

- In the 'Terms of Credit Requested' section, fill in the amount requested, select the type of credit (Loan or Line of Credit), specify the interest rate type (Fixed or Adjustable), and enter the term of credit in months.

- Complete the 'Property Information and Loan Purpose' section by providing the subject property address, number of units, legal description, year built, and selecting the loan purpose from the options such as Purchase, Construction-Initial, Home Improvement, Refinance, or Construction-Permanent.

- Fill in personal details in the 'Applicant Information' section, including names, Social Security numbers, contact information, marital status, dependents, and addresses. Ensure all information is accurate and complete.

- In the 'Employment Information' section, provide details about your current employment status, including job title, employer name and address, the duration of employment, and gross monthly income.

- Detail your monthly income and housing expenses in the corresponding section, listing all sources of income and current housing expenditures.

- In the 'Assets and Liabilities' section, accurately list your assets, including cash deposits, real estate owned, and liabilities such as loans and other debts.

- Complete the 'Declarations' section by answering questions regarding outstanding judgments, bankruptcy, and other significant financial obligations.

- Use the 'Continuation and Additional Information' section for any extra details required to complete the application.

- Review the 'Federal Notices' and 'State Notices' sections for important information applicable to your application.

- Provide your acknowledgment and consent by signing the application in the designated areas. Ensure that the signatures are clear and correspond to the information you provided.

- After completing the application, save changes, download, print, or share the form as needed for submission.

Take the next step towards your real estate goals and complete your credit application online today.

Universal Credit is made up of a basic allowance plus different elements for things like housing costs, bringing up children, caring or sickness and disability. The amount you get in Universal Credit can go down or up, depending on what income you get from: working.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.