Get Mtc Uniform Sales & Use Tax Certificate - Multijurisdiction 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MTC Uniform Sales & Use Tax Certificate - Multijurisdiction online

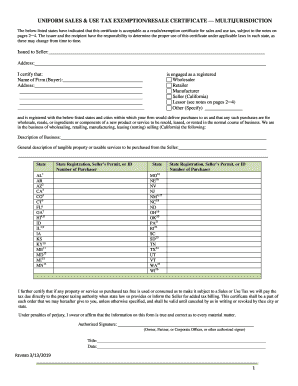

The MTC Uniform Sales & Use Tax Certificate - Multijurisdiction is a crucial document for buyers seeking to purchase goods tax-free for resale. This guide provides clear, step-by-step instructions to ensure proper completion of the certificate online, empowering users to navigate the form effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the document and open it in the online editor.

- Fill in the 'Issued to Seller' section with the seller's name and address. Ensure that the information is accurate to avoid any issues.

- In the 'Name of Firm (Buyer)' section, enter the name of your business or organization that is purchasing goods for resale.

- Provide the address of the buyer in the designated space underneath the buyer's name.

- Select the appropriate box to indicate the type of business the buyer is engaged in, such as wholesaler, retailer, manufacturer, or other. Specify if it's 'Other'.

- Describe the nature of your business in the 'Description of Business' section.

- In the 'General description of tangible property or taxable services to be purchased from the Seller' section, clearly list the items or services you intend to purchase.

- For each state listed, fill in the respective 'State Registration, Seller’s Permit, or ID Number of Purchaser' accordingly. Ensure that the information aligns with your business registrations in those states.

- Sign the certificate in the 'Authorized Signature' field. The signer must be an owner, partner, corporate officer, or an authorized person.

- Enter the title of the signer and the date of signing the certificate, confirming that the information provided is accurate.

- Once the form is complete, you can save changes, download it, print it for your records, or share it as needed.

Now that you are equipped with the knowledge to fill out the MTC certificate, complete your documents online with confidence.

Get form

In Ohio, the multiple points of use exemption certificate is utilized by businesses to avoid paying sales tax on items used at different locations. This certificate aligns with the MTC Uniform Sales & Use Tax Certificate - Multijurisdiction, making it easier for Ohio businesses to manage their exemptions. By leveraging this certificate, companies can simplify their tax processes and ensure compliance across multiple jurisdictions effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.