Loading

Get 15h Form Central Bank Of India

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 15h Form Central Bank Of India online

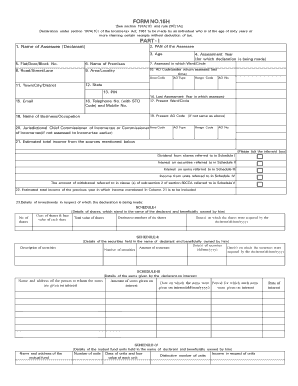

Filling out the 15h form from the Central Bank of India can be a straightforward process if you understand each component. This guide provides a detailed walkthrough to assist you in completing the form online, ensuring you meet all necessary requirements.

Follow the steps to successfully complete the 15h form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Fill in the name of the assessee (declarant) in the designated field. Make sure to enter your full name as it appears on official documents.

- Enter the Permanent Account Number (PAN) of the assessee accurately to avoid any errors.

- Indicate your age to confirm eligibility for the declaration.

- Provide your Flat/Door/Block number, ensuring accuracy to facilitate proper address recognition.

- Fill out the road/street/lane information associated with your residence.

- Specify the assessment year for which the declaration is being made, highlighting the relevant tax period.

- Provide the name of the premises, as required.

- Indicate the ward or circle where you are assessed, which is critical for tax purposes.

- Complete the locality and area details, ensuring they are up-to-date.

- Fill in the state of residence as per your residential address.

- Add the town, city, or district to clarify your location.

- Enter the PIN code for your area to finalize your address.

- Provide your email address for communication regarding your form.

- Enter your telephone number, including the STD code, and mobile number for contact purposes.

- Indicate the last assessment year in which you were assessed.

- Outline your present ward or circle for current assessment purposes.

- If applicable, fill in the present AO code, ensuring it's correct.

- Declare your name of business or occupation in the provided section.

- Supply the details regarding the estimated total income from the specified sources by ticking the relevant boxes.

- Indicate the estimated total income of the previous year that includes the income mentioned earlier.

- Complete the details of investments related to the income being declared in the scheduled sections, ensuring clarity and accuracy.

- Review all the information entered to ensure completeness and accuracy before submitting the form.

- Once all fields are complete, save changes, and you may choose to download, print, or share the form as required.

Begin filling out your 15h form online today to ensure your tax declaration is submitted accurately and on time.

In order to reduce cost and make it easy for both, the tax payer and the tax deductor, the Central Board of Direct taxes (CBDT) has simplified the format and procedure for self-declaration of Forms 15G and 15H with effect from 1 October.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.