Loading

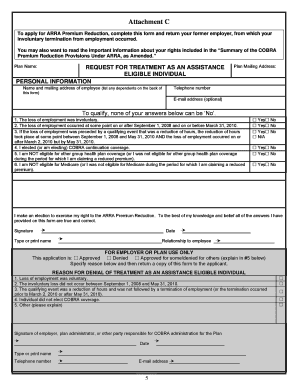

Get Request For Treatment As An Assistance Eligible Individual Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request For Treatment As An Assistance Eligible Individual Form online

Filling out the Request For Treatment As An Assistance Eligible Individual Form can be straightforward if you follow the steps carefully. This guide provides clear instructions to help you complete the form online with ease and confidence.

Follow the steps to complete your form online.

- Press the 'Get Form' button to acquire the form and open it in the online platform.

- Begin by entering your personal information in the designated fields, including your name and mailing address. If applicable, list any dependents on the back of the form.

- Provide your telephone number and an optional email address to facilitate communication regarding your application.

- Answer the qualification questions truthfully. Ensure that all your answers indicate 'Yes' if applicable, as a 'No' answer may disqualify you from assistance.

- In the signature section, sign and date the form to confirm that the information you provided is accurate to the best of your knowledge. Type or print your name underneath your signature.

- If applicable, repeat the process for any dependents by providing their information, answers to the qualification questions, and securing the necessary signatures.

- After thoroughly reviewing the completed form for accuracy, save your changes, and utilize the online options to download, print, or share the form as needed.

Complete your documents online today for efficient processing.

Form 941, the employer's quarterly federal tax return, has been updated to allow employers to claim a credit for any COBRA subsidies provided to assistance eligible individuals in ance with §9501 of the American Rescue Plan Act of 2021 (ARP).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.