Loading

Get 2019 Schedule 2

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 Schedule 2 online

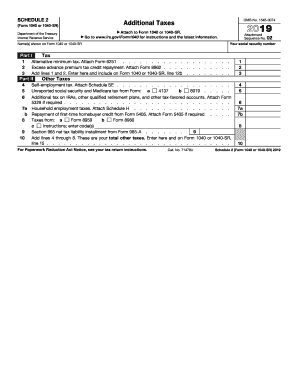

Filling out the 2019 Schedule 2 is an important step in accurately reporting additional taxes when filing your federal income tax return. This guide provides clear, step-by-step instructions to help users of all experience levels complete the form online with confidence.

Follow the steps to successfully complete your Schedule 2 form online.

- Use the ‘Get Form’ button to acquire the 2019 Schedule 2 and open it in your preferred editor.

- In the upper section of the form, provide your social security number and the names as they appear on Form 1040 or 1040-SR.

- Proceed to Part I, where you will report the following: a) For line 1, enter the alternative minimum tax (attach Form 6251 if applicable); b) For line 2, indicate any excess advance premium tax credit repayment (attach Form 8962); c) Add the amounts from lines 1 and 2, and record that sum on line 3 to include on your Form 1040 or 1040-SR, line 12b.

- Move to Part II to address other taxes: a) For line 4, report self-employment tax (attach Schedule SE); b) For line 5, indicate any unreported social security and Medicare tax from Forms 4137 or 8919; c) For line 6, include any additional tax on IRAs and other retirement accounts (attach Form 5329 if required).

- Continue in Part II: a) On line 7a, disclose household employment taxes (attach Schedule H); b) For line 7b, report repayment of the first-time homebuyer credit (attach Form 5405 if required); c) For lines 8 and 8a-c, indicate any taxes from Forms 8959 and 8960 as necessary.

- For line 9, include any net tax liability installment from Form 965-A.

- Finally, sum lines 4 through 8 and enter this total on line 10. This amount should also be included on your Form 1040 or 1040-SR, line 15. Review all entries for accuracy.

- Once you complete filling out Schedule 2, save your changes. You can then download, print, or share the form as needed.

Complete your 2019 Schedule 2 online today and ensure accurate tax reporting.

Related links form

The 2020 tax rates themselves didn't change. They're the same as the seven tax rates in effect for the 2019 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, the tax bracket ranges were adjusted, or "indexed," to account for inflation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.