Loading

Get Form Or-18-wc-v, Nonresident Real Property Conveyance Payment Voucher, 150-101-186

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form OR-18-WC-V, Nonresident Real Property Conveyance Payment Voucher, 150-101-186 online

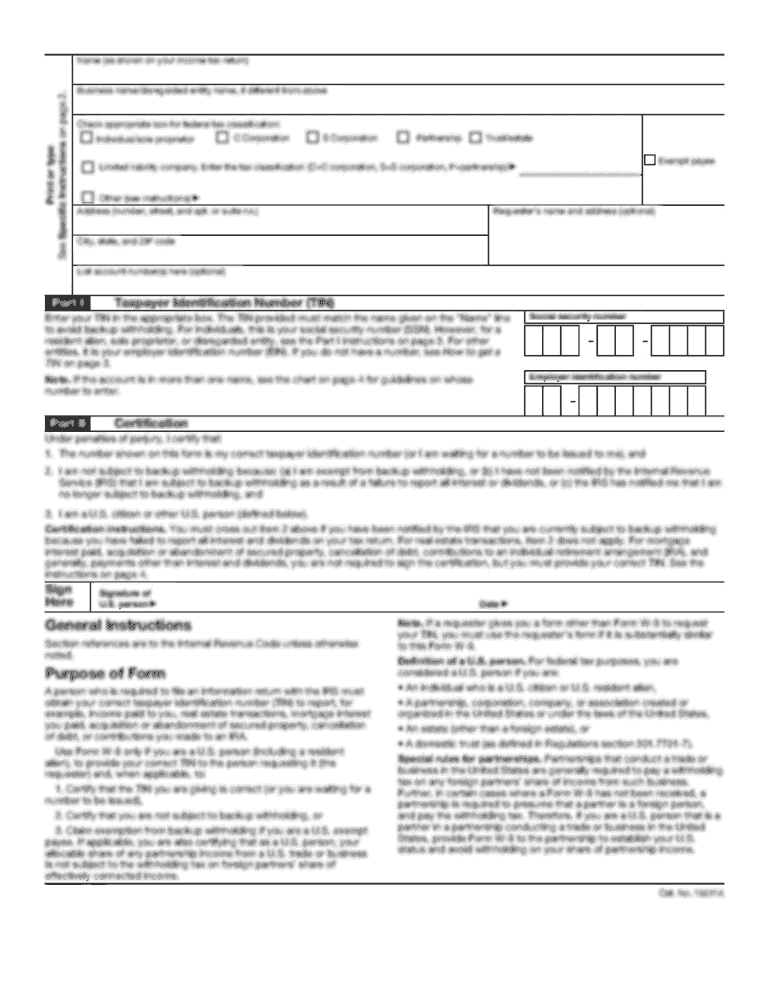

Filling out the Form OR-18-WC-V, Nonresident Real Property Conveyance Payment Voucher, is essential for those making a tax payment related to a nonresident real property transaction. This guide provides clear steps to help you easily complete the form online.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax year for which you are submitting your payment. Specify the beginning and end dates. For example, for the tax year 2020, enter 'Begins: 01/01/2020' and 'Ends: 12/31/2020'.

- Provide the transferor’s information by filling out their first name, last name, and social security number (SSN) or federal employer identification number (FEIN). Ensure all provided details are accurate, as the payment cannot be processed without this information.

- If applicable, enter the C corporation's legal name, as well as the address, city, state, and ZIP code of the filer. This is crucial for identifying the responsible party.

- Input the contact phone number to ensure that the Department of Revenue can reach you if needed.

- Enter the payment amount you are submitting. Make sure this matches the amount calculated on Part E, line 16 of Form OR-18-WC.

- Once all information is filled out, check for accuracy. After confirming all details are correct, you can save your changes, download a copy of the form, print it, or share it as necessary.

Complete your documents online now for a smoother filing experience.

Form OR-18-WC is required for all nonexempt transferors who have not provided written assurance that the entire gain is excludable from federal tax under IRC Section 121. Trans- ferors (and their authorized agents) may use this form to show that this sale is exempt by completing Parts A through C and signing the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.