Loading

Get Combination Promissory Note Btruthb-in-blending Disclosureb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Combination Promissory Note Truth-in-Lending Disclosure online

Filling out the Combination Promissory Note Truth-in-Lending Disclosure is a crucial process when securing a loan. This guide provides clear, step-by-step instructions to help you navigate each section of the form effectively, ensuring that you complete it accurately and confidently.

Follow the steps to complete the form online.

- Click the ‘Get Form’ button to access the Combination Promissory Note Truth-in-Lending Disclosure and open it in your chosen online editor.

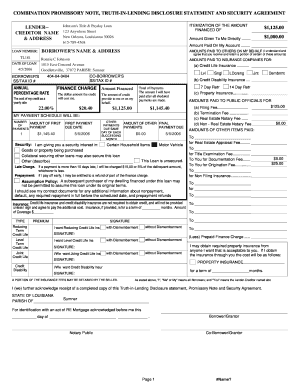

- Begin by filling in the lender's name and address, as well as your loan number. Make sure the date of the loan is accurately recorded.

- Input the total amount given to you directly and the amount paid on your account, ensuring these figures reflect your agreement.

- Provide your full name and address in the designated fields. Include your social security or tax identification number for identification.

- Fill in the annual percentage rate and finance charge, which will determine the annual cost of your credit.

- Complete the payment schedule section by detailing the amount of the first payment, its due date, and the total of payments expected over the loan term.

- Describe the security securing the loan, which may include household items, vehicles, or property. Specify if the loan is secured or unsecured.

- Review the late charge and prepayment sections. Understand your obligations regarding late payments and early repayment terms.

- Sign where indicated and ensure all required signatures for co-borrowers or partners are also provided, confirming understanding and consent.

- Once all sections are complete, save your changes, and choose whether to download, print, or share your completed Combination Promissory Note Truth-in-Lending Disclosure form.

Complete your documents online today for a smoother loan process.

Housing assistance loans for low- and moderate-income consumers are partially exempt from TRID disclosures, and have specific rules. Creditors are not required to provide Loan Estimate and Closing Disclosure forms and related booklets and statements for these loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.