Loading

Get Schedule C Business Codes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule C Business Codes online

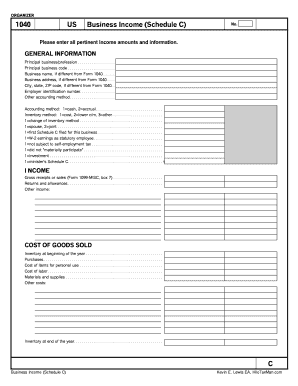

Filling out the Schedule C Business Codes is an essential step for individuals reporting business income and expenses. This guide provides clear, step-by-step instructions to help users navigate the process effortlessly.

Follow the steps to successfully complete your Schedule C Business Codes online.

- Press the ‘Get Form’ button to obtain the Schedule C form and open it in your preferred digital editor.

- Begin by entering general information: Provide your principal business or profession, and the corresponding principal business code.

- If your business name is different from what appears on Form 1040, fill in the appropriate fields with your business name and address.

- Add your employer identification number (EIN) if applicable, and specify your accounting and inventory methods.

- In the income section, enter your gross receipts, any returns or allowances, and any other relevant income amounts.

- Proceed to the cost of goods sold section and fill out the inventory details for the beginning and end of the year, purchases, and other costs.

- Complete the expenses section by detailing all relevant business expenses, which include items like advertising, vehicle expenses, and utilities.

- If you have made any asset purchases or disposals, complete the asset acquisition and disposition lists.

- Review and ensure all entries are accurate. After checking your work, save your changes, and select your preferred option to download or print the form.

Start completing your Schedule C Business Codes online today!

Use Schedule C (Form 1040 or 1040-SR) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.