Loading

Get It 219

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-219 online

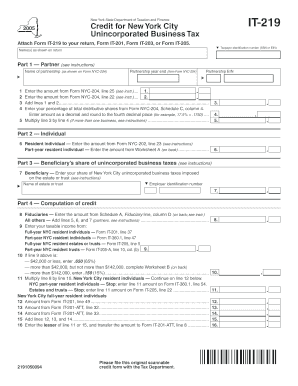

The IT-219 is a critical form for claiming the New York City unincorporated business tax credit. This guide will provide you with step-by-step instructions to help you navigate the process of filling out the form online.

Follow the steps to successfully complete your IT-219 form.

- Click ‘Get Form’ button to access the form and open it for editing.

- Enter your taxpayer identification number (either your Social Security Number or Employer Identification Number) in the designated field.

- Fill in your name(s) as shown on your return.

- In Part 1, provide the name of the partnership as it appears on Form NYC-204 and the partnership year end date from the same form.

- Enter the partnership EIN in the specified space.

- Complete the calculations for lines 1 and 2 by transferring the required amounts from Form NYC-204.

- Calculate your percentage of total distributive shares from Form NYC-204, Schedule C, column 4, ensuring to round to the fourth decimal place.

- Multiply line 3 by line 4 to calculate the totals if you are involved in more than one business per the instructions.

- Proceed to Part 2 and enter the required amounts for resident or part-year resident individuals.

- In Part 3, input your share of New York City unincorporated business taxes imposed on the estate or trust.

- Continue to Part 4 and provide the necessary calculations for lines 8, 9, and 10 based on your taxable income.

- Complete the calculations on lines 11 and 12, entering the lesser amount where indicated.

- Review your entries carefully. Once complete, save your changes, and you can choose to download, print, or share the completed IT-219 form.

Complete the IT-219 form online to finalize your claim for the New York City unincorporated business tax credit.

Who must file the 1127 tax return? Any New York City employee who was a nonresident of the City (the five NYC boroughs) during any part of a particular tax year must file an 1127 return. In most cases, if you received an 1127.2 statement from your employer, you must file an 1127 return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.