Loading

Get Mississippi Contractor's Application For Material Purchase Certificate ... - Dor Ms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mississippi Contractor's Application For Material Purchase Certificate online

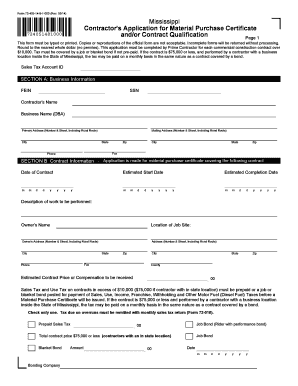

Filling out the Mississippi Contractor's Application For Material Purchase Certificate is an essential step for contractors seeking to work on commercial construction projects. This guide provides a clear and detailed approach to completing the application accurately and efficiently.

Follow the steps to complete your application successfully.

- Click the ‘Get Form’ button to access the application and open it in your chosen editing tool.

- Begin by filling out the basic information in SECTION A: Business Information. Enter the contractor's name, business name (DBA), and contact information, including address, phone number, and fax details.

- Provide the necessary details regarding the contract in SECTION B: Contract Information. Include the estimated start and completion dates, the estimated contract price, description of the work to be performed, and location of the job site.

- If there are subcontractors involved, complete SECTION C: Subcontractor Information. Provide their names, addresses, and the specific work they will perform.

- Ensure that required taxes are accurately calculated and indicated, especially if the contract price is over $10,000. Refer to the guidelines regarding prepaid taxes or bonding requirements.

- Review all information provided, ensuring that it is complete and accurate. This form must be typed or printed, and any errors can result in delays.

- Once all sections are filled out, save your changes. You can download the completed application for your records or print it for submission.

- To submit the application online, follow the guidelines to log into your TAP account on the appropriate platform.

Complete your Mississippi Contractor's Application For Material Purchase Certificate online today to ensure a smooth submission process.

In most states, construction contractors must pay sales tax when they purchase materials used in construction. This means that any materials and supplies you purchase are taxable at the time of purchase. However, you won't have to pay sales or use tax upon the sale of the finished construction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.