Loading

Get Springfield City Tax Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Springfield City Tax Forms online

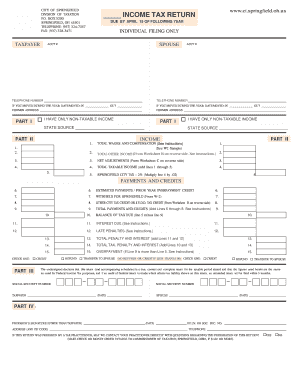

Filling out your Springfield City Tax Forms online can streamline your tax preparation process. This guide will walk you through the components of the forms and provide clear, step-by-step instructions to assist you in accurately completing your tax return.

Follow the steps to successfully complete your Springfield City Tax Forms.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information, such as your name, account number, and contact details, ensuring accuracy for efficient processing.

- If you moved during the year, indicate the date you moved in and out, as well as your former address to help the city maintain current records.

- In Part I, state your income tax return status. Select whether you have only non-taxable income or if you are not required to file, providing reasons and the sources of your income if applicable.

- In Part II, detail your income. Begin with total wages and compensation, referencing your W-2 forms for accuracy, and follow with other income sources using Worksheet B.

- Calculate your net adjustments using Worksheet C, ensuring to provide necessary documentation and calculations as support.

- Add your income components together to determine your total taxable income, and compute your tax by multiplying it by the applicable municipal rate.

- Report your payments and credits, including any estimated payments made or amounts withheld for Springfield on your W-2.

- If you have any penalties or interest due, report these as outlined in the form, following the instructions provided.

- At the conclusion of your form, review for completeness. You can save your changes, download, print, or share the form as necessary.

Complete your Springfield City Tax Forms online now to ensure timely and accurate filing.

To access online forms, select "Individuals" at the top of the IRS website and then the "Forms and Publications" link located on the left hand side of the page. You will then see a list of printable forms, including the 1040, 1040-EZ, 4868 form for an extension of time and Schedule A for itemized deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.