Loading

Get Cfnc Deferment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cfnc Deferment online

Completing the Cfnc Deferment form online can be a straightforward process with the right guidance. This user-friendly guide will walk you through each section of the form, ensuring you have the necessary information to submit your request successfully.

Follow the steps to complete your deferment request online.

- Press the ‘Get Form’ button to access the deferment request form and open it for editing.

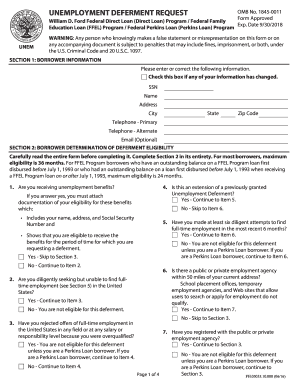

- In Section 1, enter your borrower information, including your Social Security Number, name, address, state, city, zip code, and telephone numbers. Ensure all details are accurate. Check the box if any of your information has changed.

- Move to Section 2 to determine your eligibility for a deferment. Respond to each question truthfully, including whether you are receiving unemployment benefits and if you have made diligent attempts to seek full-time employment.

- In Section 3, confirm your request for deferment by providing the date you became unemployed or began working less than full-time. Initial each understanding and certification to validate your request.

- Follow the instructions in Section 4 carefully, typing or printing using dark ink. Enter any required dates in the specified format (mm-dd-yyyy) and include your name and account number on additional documentation.

- Address the completed form and any required documentation to the address specified in Section 6. Ensure you send it to the correct loan holder.

- Review your completed deferment request for accuracy before submitting. After ensuring all information is correct, you may save the form, download it for your records, print it, or share it as needed.

Complete your Cfnc Deferment request online today to manage your student loans effectively.

You are eligible for this deferment if you're enrolled at least half-time at an eligible college or career school. If you're a graduate or professional student who received a Direct PLUS Loan, you qualify for an additional six months of deferment after you cease to be enrolled at least half-time. Important!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.