Loading

Get It 2664

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-2664 online

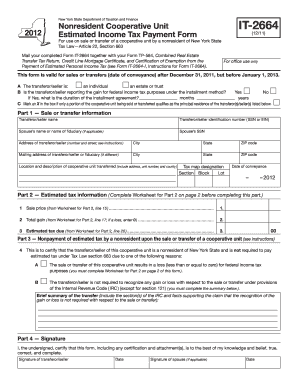

The IT-2664 form is essential for nonresidents of New York State who are involved in the sale or transfer of a cooperative unit. This guide will walk you through the steps necessary to successfully complete the form online, ensuring that you have all the required information at your fingertips.

Follow the steps to fill out the IT-2664 form online.

- Press the ‘Get Form’ button to access the IT-2664 form and open it in the online editor.

- In Part 1, provide the transferor or seller's name and identification number, including spouse’s name if applicable, and addresses. Ensure that all names are spelled correctly and that the identification numbers match official documents.

- Complete the section detailing the location and description of the cooperative unit being sold or transferred. Include the address, unit number, county, and the date of conveyance.

- Move to Part 2, and before entering values, ensure that you complete the Worksheet for Part 2 as instructed on page two. Here, you will input the sale price, total gain, and estimated tax due as calculated from the worksheet.

- In Part 3, if applicable, certify the reasons for nonpayment of estimated tax, such as a loss on the sale or nonrecognition of gain or loss as per the Internal Revenue Code. Provide a brief summary if necessary.

- Finally, in Part 4, sign and date the form. If a spouse or fiduciary is involved, ensure their signature and date are also provided.

- After reviewing the completed form for accuracy, save the changes. You can then download, print, or share the IT-2664 form as needed.

Complete your IT-2664 form online today to ensure compliance and a smooth transaction.

The fiduciary of a New York State resident estate or trust must file a return on Form IT-205 if the estate or trust: – is required to file a federal income tax return for the tax year; – had any New York taxable income for the tax year; or – is subject to a separate tax on lump-sum distributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.