Loading

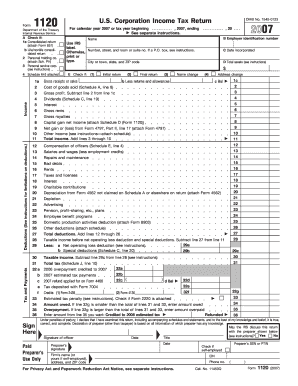

Get 2007 1120 Corp Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 1120 Corp Return Form online

Filing the 2007 1120 Corp Return Form is an important task for corporations to ensure proper reporting of income, deductions, and tax obligations. This guide provides clear, step-by-step instructions on how to fill out this form online, helping users navigate the complexities of corporate tax reporting.

Follow the steps to complete your 2007 1120 Corp Return Form online.

- Click ‘Get Form’ button to access the 2007 1120 Corp Return Form and open it for editing.

- Begin by filling out the basic information: Enter the employer identification number, company name, address, and other identifying details on the form.

- Indicate if the form is a consolidated return or if the corporation has specific designations such as a personal holding company or personal service corporation.

- In the income section, provide the gross receipts or sales figures and detail costs of goods sold to calculate gross profit.

- List all types of income, including dividends, interest, and rents, in the specified fields and sum these amounts to report total income.

- Next, move to deductions: Fill in the appropriate fields such as compensation of officers, salaries and wages, and other business expenses. Total these deductions for the final calculation.

- Calculate taxable income by subtracting total deductions from total income. Report this amount in the designated line.

- Determine the total tax due based on the taxable income and complete any applicable additional tax forms as required.

- Sign the form where indicated, confirming the accuracy and completeness of the information provided.

- Finally, users can save changes, download a copy of the filled form for their records, print it, or share it as needed.

Complete your 2007 1120 Corp Return Form online today to ensure accurate tax reporting.

A regular corporation (also known as a C corporation) is taxed as a separate entity. The corporation must file a Form 1120 each year to report its income and to claim its deductions and credits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.