Loading

Get Form It 203c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form It 203c online

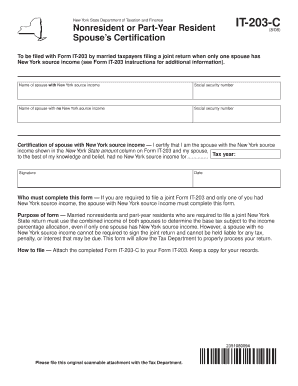

Filling out the Form It 203c correctly is essential for married taxpayers filing a joint return when only one spouse has New York source income. This guide provides clear, step-by-step instructions to assist users in completing the form online.

Follow the steps to complete the Form It 203c online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the name of the spouse with New York source income, along with their social security number. Ensure that the information is accurate to avoid processing delays.

- In the next field, include the name of the spouse with no New York source income, followed by their social security number. This information is crucial for the Tax Department’s records.

- Complete the certification section. The spouse with New York source income must affirm, to the best of their knowledge, that the other spouse had no New York source income for the specified tax year. It is important to fill in the tax year in the provided space.

- Ensure both spouses sign and date the form where indicated. The signature of the spouse with New York source income is required for the certification to be valid.

- Once all fields are filled, save your changes. You can download, print, or share the completed Form It 203c as needed. Be sure to keep a copy for your records.

Complete and submit your documents online today for efficiency and accuracy.

Will stimulus payments be taxed? Nope. The so-called economic impact payments are not treated as income. In fact, they're technically an advance on a tax credit, known as the Recovery Rebate Credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.