Loading

Get Nj Reg-c-l 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ REG-C-L online

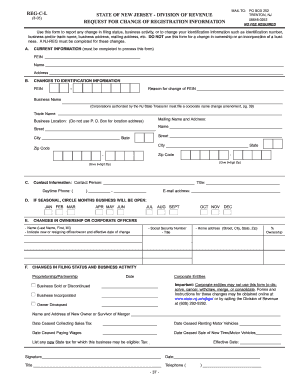

The NJ REG-C-L form is essential for reporting changes in your business registration information in New Jersey. This guide provides a systematic approach to filling out the form online, ensuring you complete each section accurately and efficiently.

Follow the steps to complete the NJ REG-C-L form online.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred editing software.

- Fill out section A with your current information, including your Federal Employer Identification Number (FEIN), name, and address. Ensure all details are accurate as they are necessary for processing the form.

- In section B, indicate any changes to your identification information. This includes updating your FEIN, business name, trade name, mailing address, and business location. Remember that the business location should not be a P.O. Box.

- Complete section C by providing the contact information of a representative for your business, including their name, title, and daytime phone number.

- If your business is seasonal, circle the months listed in section D to indicate when your business will be open.

- Section E requires details about any changes in ownership or corporate officers, including names, titles, and ownership percentages, along with the effective dates of these changes.

- In section F, provide your email address for further correspondence and any other relevant details regarding your changes.

- Sign the form in the designated space, and ensure you include the current date and your title.

- After completing the form, save any changes made, and download or print the completed form for your records.

- Finally, you can share or submit your form as required by your business needs.

Complete your NJ REG-C-L form online today to ensure your business information is up-to-date.

In New Jersey, a Taxpayer Identification Number (TIN) is generally obtained through the IRS. You can apply online, by mail, or by fax, depending on your preference. The process is straightforward, and once you receive your TIN, you can use it for various tax-related purposes. Remember, having a TIN is important for compliance with federal tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.