Loading

Get Dol Ca-20 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DoL CA-20 online

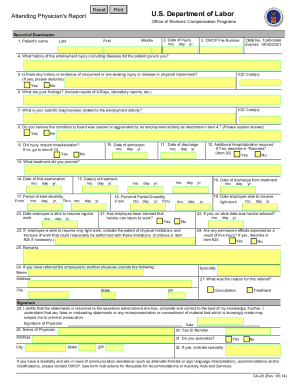

The DoL CA-20 form, also known as the Attending Physician's Report, is crucial for documenting the medical history and findings related to an injury sustained during employment. This guide will provide clear and straightforward instructions to help you fill out the form accurately while filing online.

Follow the steps to successfully complete the DoL CA-20 form

- Click ‘Get Form’ button to access the CA-20 form online.

- Begin by entering the patient's name in the designated fields for first, middle, and last names.

- Provide the date of injury in the format of month, day, and year.

- Enter the OWCP file number, which is essential for processing the claim.

- Detail the history of the employment injury as explained by the patient in the given section.

- Indicate if there is any concurrent or pre-existing injury, providing details if applicable.

- List your findings, including any relevant tests such as X-rays or lab results.

- Specify the diagnosis relating to the employment activity and evaluate if the injury was caused or aggravated by said activity.

- Record the hospitalization status and, if necessary, provide the date of admission and discharge.

- In the treatment section, provide a description of the treatment given.

- Document the full period of total disability, including specific start and end dates.

- Specify when the employee can resume regular and/or light work, and any limitations they may have.

- Complete any additional remarks or descriptions relevant to the patient's condition and needed accommodations.

- After reviewing all entered information for accuracy, save the changes, and choose to download, print, or share the completed form as needed.

Complete the DoL CA-20 form online today to ensure the timely processing of your claim.

Related links form

Code 4560 is a provision in the California labor code that requires insurance companies to pay a 10% penalty for overdue payments on temporary or permanent disability payments. In most cases, temporary disability benefit payments are due starting 14 days after knowledge of the disability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.