Loading

Get Mi Lc-621 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI LC-621 online

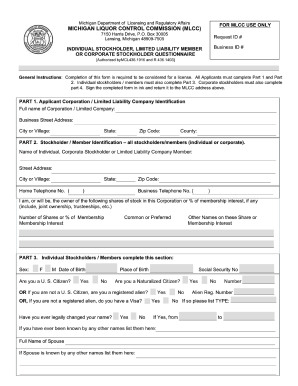

Filling out the MI LC-621 form is essential for those seeking a liquor control license in Michigan. This user-friendly guide will walk you through the process step by step to ensure you complete your application accurately and efficiently.

Follow the steps to successfully fill out the MI LC-621 form online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Begin with Part 1, where you will provide your business information. Fill in the full name of your corporation or limited liability company, along with the business street address, city or village, state, zip code, and county.

- Move on to Part 2, which requires the identification of all stockholders or members. Enter the name of the individual or corporate stockholder, their street address, city or village, state, home telephone number, business telephone number, and the percentage of ownership or number of shares they hold.

- If you are an individual stockholder or member, complete Part 3. Fill in your sex, date of birth, citizenship status, place of birth, and social security number. If applicable, provide details regarding naturalization, name changes, and other identities.

- Now focus on Part 4 if you are a corporate stockholder. Input the corporation or LLC name, incorporation date, state of incorporation, authorization date, and resident agent contact information.

- Complete the remaining fields regarding corporate officer information, number of shares authorized and issued, and the individual authorized to sign the application.

- Double-check all sections for accuracy and completeness. After you have filled out all relevant information, return to the top of the form to review the warnings and affirmations before signing.

- Save your completed form, and prepare it for submission. You can download, print, or share the form as necessary.

Start filling out your MI LC-621 form online today to ensure a smooth application process!

You do need to attach your W-2 when filing your Michigan tax return. This document is crucial for accurately reporting your income to the state. Attaching it helps the Michigan Department of Treasury verify your earnings efficiently. Always keep a copy of your W-2 for your personal records as well.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.