Loading

Get Irs 5884-c 2021-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5884-C online

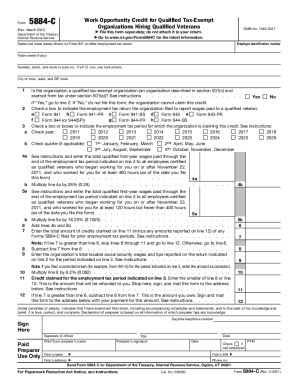

Form 5884-C is used by qualified tax-exempt organizations to claim the work opportunity credit for qualified veterans. This guide provides clear and structured steps to help you navigate the process of completing the form online, ensuring you can efficiently claim the credits for which your organization may be eligible.

Follow the steps to complete the IRS 5884-C form online.

- Press the ‘Get Form’ button to access the IRS 5884-C form online and open it in your preferred editor.

- Enter the employer identification number at the top of the form.

- Provide the organization’s legal name as shown on Form 941 or another employment tax return.

- Indicate any trade name, if applicable.

- Fill in the organization’s address, including the street number, room or suite number, city, state, and ZIP code.

- Answer the question about qualified tax-exempt organization status by selecting ‘Yes’ or ‘No’ on line 1.

- If applicable, select the appropriate employment tax return filed for reporting wages paid to a qualified veteran on line 2.

- Indicate the employment tax period for which the organization is claiming the credit on line 3 by checking the corresponding year and quarter.

- On line 4a, enter the total qualified first-year wages paid to qualified veterans who worked at least 400 hours. Calculate line 4b by multiplying line 4a by 26%.

- On line 5a, enter the total qualified first-year wages for veterans who worked between 120 and 400 hours. Multiply by 16.25% for line 5b.

- Add line 4b and line 5b together to complete line 6.

- Enter any credits claimed from previous forms on line 7, and calculate accordingly.

- If relevant, complete lines 8 to 11, ensuring proper calculations based on prior credits.

- Sign and date the form in the designated area after reviewing all provided information.

- Finalize your filing by saving, downloading, printing, or sharing the completed form as needed.

Begin completing your IRS 5884-C form online today to ensure you access potential credits for your organization.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.