Loading

Get Sba Form 5 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Form 5 online

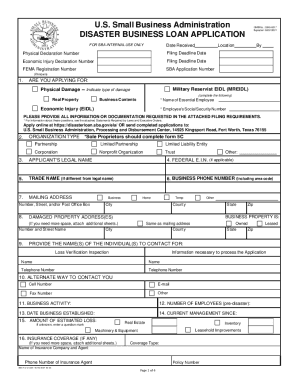

The Sba Form 5 is an essential document for businesses seeking a disaster loan from the U.S. Small Business Administration. This guide provides an easy-to-follow approach for filling out the form online, ensuring that users can complete the application accurately and efficiently.

Follow the steps to complete the Sba Form 5 online.

- Press the ‘Get Form’ button to acquire the form and open it within the online editor.

- Begin by entering the date received and any internal use numbers provided by the SBA.

- Indicate whether you are applying for physical damage or economic injury by checking the appropriate boxes.

- Complete the organization type section by selecting the business structure that applies, such as corporation or partnership.

- Provide the applicant's legal name along with the trade name, if it is different.

- Enter the mailing address, including the street, city, state, and zip code.

- Detail the damaged property addresses if applicable, and indicate whether the business property is owned or leased.

- List the business activity and the number of employees prior to the disaster.

- Provide the date the business was established and the current management's start date.

- Estimate your losses and detail any insurance coverage you may have, including policy numbers.

- Fill in the owners' information, including their names, titles, and ownership percentages.

- Answer the questions regarding any legal issues that may affect the business or the owners.

- After completing all sections of the form, review your information for accuracy.

- Save your changes, and choose whether to download, print, or share the completed form as needed.

Start filling out the Sba Form 5 online today to expedite your disaster loan application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.