Loading

Get Or Dor Or-ez-exclm 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR DoR OR-EZ-EXCLM online

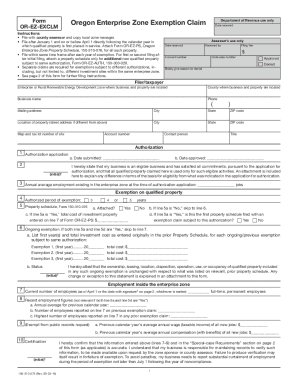

Filling out the OR DoR OR-EZ-EXCLM form is an important step for businesses seeking an exemption on qualified property in Oregon's enterprise zones. This guide provides a clear, step-by-step approach to help users complete the form accurately and efficiently.

Follow the steps to successfully complete the OR DoR OR-EZ-EXCLM online.

- Press the ‘Get Form’ button to access the OR DoR OR-EZ-EXCLM form and launch it in the online editor.

- Complete the filer/taxpayer section, including the business name, contact person, and their title. Ensure that all contact information is accurate, including the business mailing address and phone number.

- Specify the location of the property by providing the street address, city, state, and ZIP code. Additionally, include the map and tax lot number associated with the property.

- Fill out the authorization section by indicating the date the application was submitted and approved. Ensure you initial this section to confirm compliance with authorization commitments.

- Indicate the authorized period of exemption by selecting whether you are applying for a three, four, or five-year exemption. Attach Form OR-EZ-PS, Oregon Enterprise Zone Property Schedule, if applicable.

- Complete the employment information section by entering the current number of full-time, permanent employees as of the deadline, and include previous employment figures if relevant.

- In the certification section, verify that all information provided is accurate by initialing. This confirms your acknowledgment of the penalties for false swearing.

- Sign and date the declaration, ensuring it is completed by an owner, company executive, or an authorized representative. Note the title for clarity.

- Review all sections of the form for accuracy and completeness before submitting.

- After final review, users can save changes, download, print, or share the completed form as needed.

Complete your OR DoR OR-EZ-EXCLM form online today to take advantage of potential tax exemptions.

(1) A homestead shall be exempt from sale on execution, from the lien of every judgment and from liability in any form for the debts of the owner to the amount in value of $40,000, except as otherwise provided by law. The exemption shall be effective without the necessity of a claim thereof by the judgment debtor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.