Loading

Get Or Notice Of Clients Trust Account & Authorization To Examine 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Notice Of Clients Trust Account & Authorization To Examine online

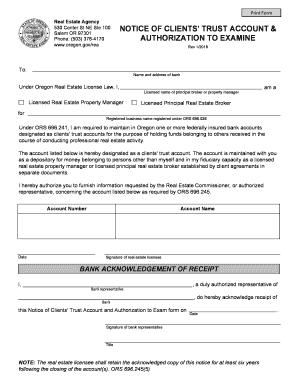

Filling out the OR Notice Of Clients Trust Account & Authorization To Examine online is an essential step for licensed real estate professionals in Oregon. This guide provides clear instructions for completing the form accurately and efficiently.

Follow the steps to complete the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- In the first section, input the name and address of the bank where the clients’ trust account is held. Ensure the information is accurate to avoid any discrepancies.

- In the next section, fill in your name as the licensed real estate property manager. Then, enter the licensed name of the principal broker or property manager for whom you are acting.

- Indicate your professional status, whether you are a licensed principal real estate broker or another designation, and ensure you have the correct designation selected.

- Provide the registered business name that has been registered under ORS 696.026. This step confirms your business's legitimacy.

- Next, complete the account number for the clients' trust account you are designating. This is crucial for the identification of your trust account.

- Select the date on which you are filling out this form. Accuracy in the date helps maintain a proper record.

- Enter the name associated with the account to clarify the account holder's identity.

- Sign the form to authorize the information outlined. Your signature is an acknowledgment of the trust obligations.

- In the bank acknowledgment section, a bank representative must fill in their name, bank name, and the date of receipt. Their signature and title will also be required to validate this acknowledgment.

- Once all sections are complete, save your changes and download or print the form for your records. Ensure you retain the acknowledged copy for at least six years as required.

Complete your OR Notice Of Clients Trust Account & Authorization To Examine online today for a smooth filing process.

Your attorney cannot give you money in the form of a loan. ... The American Bar Association prohibits lawyers from subsidizing lawsuits or administrative proceedings brought on behalf of their clients, including making or guaranteeing loans to their clients for living expenses among other things.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.