Loading

Get Request To Employer To Report Wages Each Month. Use This Form To Request An Employer To Report

This website is not affiliated with any governmental entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the REQUEST TO EMPLOYER TO REPORT WAGES EACH MONTH. Use This Form To Request An Employer To Report online

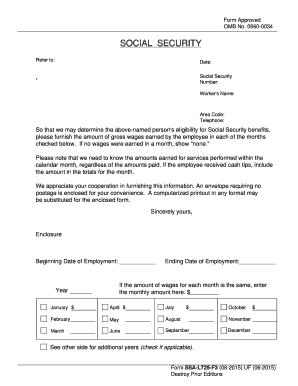

This guide provides clear and comprehensive instructions for completing the Request to Employer to Report Wages Each Month form. Ensuring accuracy and completeness in this form is crucial for determining eligibility for Social Security benefits.

Follow the steps to successfully complete this form.

- Press the ‘Get Form’ button to access the form and open it in your preferred browser.

- Begin by filling in the date at the top of the form. This should be the current date when you are completing the form.

- Enter the Social Security number of the employee on the designated line to help identify their information correctly.

- Record the worker's name as it appears on their Social Security documentation. Ensure it's accurate to avoid complications.

- Provide your area code and telephone number in the next fields. This allows for easy communication if further clarification is needed.

- Indicate the beginning and ending dates of employment for the individual in the respective fields. Accurate dates are necessary for proper wage evaluation.

- For each month listed in the table, input the gross wages earned during that month. If no wages were earned, clearly write 'none.' Check the box for months that have wage report entries.

- If the employee received cash tips, be sure to include these amounts in the monthly totals. This information is crucial regardless of how the pay is received.

- If the wages for each month are the same, you may enter the consistent monthly amount once at the provided location to streamline the process.

- At the bottom of the form, declare the accuracy of the information provided by signing and dating as the employer. This confirms that all details are true to the best of your knowledge. Remember to include your name and title.

Complete and submit your documents online for a seamless process.

Why the IRS and SSA require employers to file Form W-3. When individuals file their annual tax return, they report the total income they've earned, taxes already paid (usually via employer withholding), and tax owed (or due to be refunded).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.