Loading

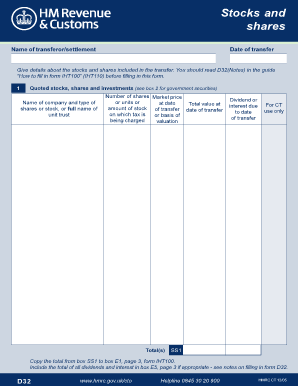

Get Uk Hmrc D32 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC D32 online

The UK HMRC D32 form is essential for users seeking to submit their tax information accurately. This guide provides step-by-step instructions to help you navigate the online form with confidence and ease.

Follow the steps to complete your UK HMRC D32 form online.

- Click the ‘Get Form’ button to access the document and open it for editing.

- Review the first section of the form, which typically requires basic personal information, including your name, address, and unique taxpayer reference.

- Proceed to the next section, where you will need to input your financial details, including income and relevant expenses that apply.

- Check for additional fields that may require data related to specific allowances or deductions you are eligible for.

- Once all required sections are filled out, thoroughly review your entries for accuracy and completeness.

- Save your changes, and once satisfied, you can download, print, or share the completed form as necessary.

Start completing your UK HMRC D32 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Gifts to individuals that aren't immediately tax-free will be considered as 'potentially exempt transfers'. This means that they will only be tax-free if you survive for at least seven years after making the gift. If you die within seven years, the gift will be subject to Inheritance Tax.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.