Loading

Get Ssa-7163 2021-2026

This website is not affiliated with any governmental entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-7163 online

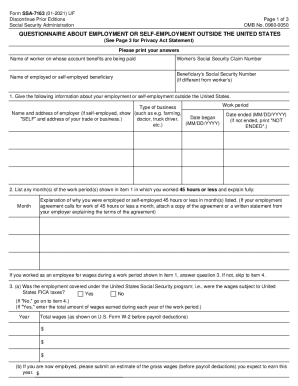

This guide provides clear, step-by-step instructions for completing the SSA-7163 form, which is a questionnaire about employment or self-employment outside the United States. The process of filling out this form online is designed to be straightforward and user-friendly.

Follow the steps to successfully complete your SSA-7163 online.

- Click the ‘Get Form’ button to access the SSA-7163 document and begin the completion process. Ensure you have a reliable internet connection for smooth access.

- Provide the name of the worker on whose account benefits are being paid, and include their Social Security Claim Number. If applicable, include the name and Social Security Number of the employed or self-employed beneficiary.

- In the first section, provide complete details about your employment or self-employment outside the United States. Include the work period, type of business, and name and address of the employer or trade/business.

- List any month(s) during the work period where you worked 45 hours or less. Explain why you were engaged in fewer hours, and attach any relevant employment agreements as necessary.

- If you were employed, indicate whether the employment was covered under the United States Social Security program. If yes, report the total wages earned each year during the work period.

- For self-employment inquiries, confirm your legal residency status or citizenship. If you chose coverage under a different Social Security program, specify the country. Attach any required documents if necessary.

- Indicate if you filed income tax returns with the IRS for the relevant years. If affirming, attach the required tax documents. If not, provide detailed financial information regarding gross earnings, expenses, and earnings net.

- Finally, complete the declaration portion by signing and dating the form, and include your mailing address and telephone number. If signed by mark, ensure two witnesses sign as well.

- Review all provided information for accuracy, then save your changes. You can download, print, or share the completed SSA-7163 form as needed.

Start completing your SSA-7163 form online today for a streamlined filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.