Loading

Get Va Form 26-8736a. Nonsupervised Lender's Nomination And Recommendation Of Credit Underwriter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form 26-8736a. NONSUPERVISED LENDER'S NOMINATION AND RECOMMENDATION OF CREDIT UNDERWRITER online

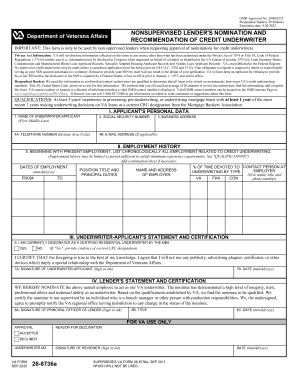

Filling out the VA Form 26-8736a properly is crucial for non-supervised lenders nominating a credit underwriter. This guide provides comprehensive, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to fill out the VA Form 26-8736a seamlessly.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin filling in the applicant's personal data section by entering the name of the underwriter-applicant in the designated field.

- Provide the social security number of the underwriter-applicant accurately in the corresponding box.

- Include the business address of the applicant in the appropriate section, ensuring all details are entered correctly.

- Enter the telephone number and, if applicable, the email address of the underwriter-applicant.

- Proceed to the employment history section. List all relevant employment chronologically, starting from the present. Ensure to include dates, position titles, and principal duties.

- Detail the percentage of time devoted to underwriting and provide contact information for the employer's contact person.

- In the underwriter-applicant's statement and certification part, indicate whether you are currently designated as a certified residential underwriter by the MBA. If yes, attach evidence of the current designation.

- Sign and date the form in the appropriate sections to certify the accuracy of the provided information.

- The lender's statement and certification section requires the signature of the principal officer of the lender, along with their title and date.

- Finally, check all entries for accuracy and completeness before saving changes, and you may also choose to download, print, or share the completed form.

Complete and submit your document online to ensure a smooth nomination process.

Credit Problems. ... Most lenders will pull your credit report again just before closing, so any new credit dings could sidetrack your purchase.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.