Loading

Get Pa Uc-2 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA UC-2 online

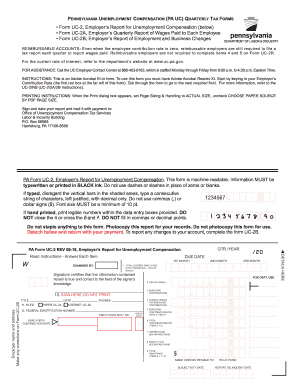

This guide provides a step-by-step approach to filling out the PA UC-2 form, which is used for reporting unemployment compensation by employers in Pennsylvania. Whether you are a seasoned professional or new to this task, this comprehensive guide will help you navigate the process smoothly.

Follow the steps to effectively complete the PA UC-2 form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering your Employer’s Contribution Rate in the first red box located at the left side of the form. Make sure to provide this information accurately as it determines your contribution obligations.

- Tab through the form to navigate to the next required fields. Each field must be completed with valid information including your Employer’s Account Number, Federal Identification Number, and total covered employees for the pay period.

- Input the gross wages and taxable wages for employer contributions. Ensure correct figures are entered to avoid potential discrepancies in your report.

- Provide the amounts for employee contributions, and calculate the total contributions due by adding the employee contributions and employer contributions.

- If applicable, calculate and enter any interest and penalties due according to the instructions provided. Review these calculations carefully to ensure compliance.

- Review all entered information for accuracy. Once confirmed, print the document in proper format by setting the print dialog box to 'Actual Size' and avoiding common pitfalls such as using commas or dollar signs.

- Sign and date your report to certify the accuracy of the information provided. If corrections are necessary, reference Form UC-2B.

- Mail the completed form along with payment to the designated address. It is recommended to keep a photocopy of the report for your records.

- Once finished, you can save changes, download a copy, print it, or share the form as needed.

Complete and submit your PA UC-2 form online today to ensure compliance and timely reporting.

Employers are responsible for withholding a specific percentage for Pennsylvania unemployment compensation tax from their employees' wages. This withholding ensures that funds are available for workers who claim unemployment benefits. To manage this effectively, consider using resources like USLegalForms for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.