Loading

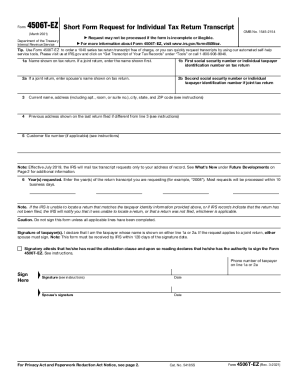

Get Form 4506t-ez (rev. 3-2021)

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4506T-EZ (Rev. 3-2021) online

Filling out the Form 4506T-EZ (Rev. 3-2021) online is a straightforward process that allows individuals to request their tax return transcripts efficiently. This guide provides a clear, step-by-step approach to ensure users can complete the form accurately and easily.

Follow the steps to complete the form successfully.

- Click the ‘Get Form’ button to access the document and open it in your preferred editor.

- In line 1a, provide the name shown on your tax return. If you filed a joint return, enter the first name listed.

- Enter your first social security number or individual taxpayer identification number in line 1b.

- If applicable, input your spouse’s name in line 2a. This is for joint returns only.

- Provide your spouse’s second social security number or individual taxpayer identification number in line 2b, if necessary.

- Fill in your current address in line 3, including any apartment, room, or suite number.

- If your previous address differs from the current one, provide it in line 4.

- Optionally, enter a customer file number in line 5. This number is used to uniquely identify your request.

- Specify the year(s) of the tax return transcript you are requesting in line 6.

- Do not sign the form until all applicable lines have been completed. Provide your signature and date in the designated area.

- If applicable, have your spouse sign and date in their respective area.

- Finally, save your changes, download the completed form, print a copy for your records, and submit it to the IRS based on the provided filing instructions.

Start filling out your Form 4506T-EZ online today to streamline your tax document requests.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Please visit us at IRS.gov and click on Get a Tax Transcript... under Tools or call 1-800-908-9946. If you need a copy of your return, use Form 4506, Request for Copy of Tax Return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.