Loading

Get Common Reporting Standard (crs) Self ... - Cimb Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Common Reporting Standard (CRS) Self-Certification for Entities - CIMB Bank online

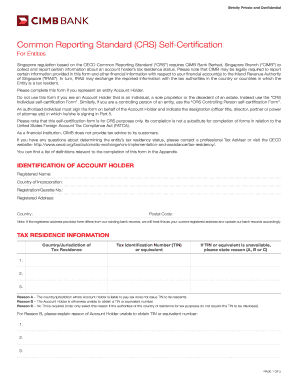

Filling out the Common Reporting Standard (CRS) Self-Certification form is essential for entities opening accounts with CIMB Bank. This guide will navigate you through the process, ensuring you understand each section of the form and how to complete it effectively.

Follow the steps to complete the CRS Self-Certification form online.

- Click the ‘Get Form’ button to obtain the Common Reporting Standard (CRS) Self-Certification form and open it in the provided editor.

- In the 'Identification of Account Holder' section, provide the registered name of the entity, country of incorporation, registration or gazette number, registered address, postal code, and the country. Ensure that the address matches the records to avoid updates.

- Proceed to fill in the 'Tax Residence Information'. List the country or jurisdiction of tax residence alongside the Tax Identification Number (TIN) or its equivalent. If TIN is not available, specify one of the reasons A, B, or C, and provide explanations if applicable.

- In the 'Entity Type' section, tick the box that corresponds to the type of entity you represent (e.g., Financial Institution, Non-Financial Entity) and complete any additional required fields about the selected type.

- If applicable, in the 'Controlling Person' section, indicate the names of any controlling persons of the account holder and ensure that the corresponding 'Common Reporting Standard (CRS) Controlling Person Self-Certification form' is completed for each person.

- For the declaration section, read the terms carefully and confirm your understanding by signing on behalf of the account holder, including names, dates, and designations. Ensure that at least one authorized individual is signing.

- Once all information has been accurately filled out, save the changes made to the form. You can then download, print, or share the completed form as necessary.

Complete your CRS Self-Certification form online to ensure compliance with tax regulations.

Tax Identification Number/National Insurance Number (or equivalent where applicable) Account details (of the bank account or similar) The total account balance/value of your accounts calculated at the end of the calendar year, including any interest (excluding the balance of any excluded accounts)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.