Loading

Get Ssa-44 2020

This website is not affiliated with any governmental entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-44 online

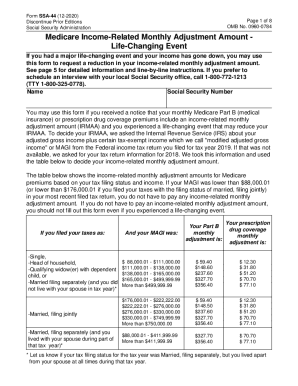

The SSA-44 form is designed for requesting a reduction in your income-related monthly adjustment amount due to a life-changing event. This guide provides clear, step-by-step instructions on how to complete the SSA-44 online, ensuring you have the necessary information and support.

Follow the steps to successfully fill out the SSA-44 online.

- Press the ‘Get Form’ button to access the SSA-44 and open it in a digital format.

- Identify the type of life-changing event you experienced. Check the appropriate box and fill in the date the event occurred (mm/dd/yyyy). Options include marriage, work reduction, divorce/annulment, loss of income-producing property, death of your partner, loss of pension income, work stoppage, or employer settlement payment.

- Enter the tax year in which your income was impacted by the life-changing event, along with your adjusted gross income (AGI) and tax-exempt interest for that specific tax year. Also, select your tax filing status from the provided options.

- If applicable, indicate whether your modified adjusted gross income will be lower next year and provide the estimated adjusted gross income, estimated tax-exempt interest, and expected tax filing status for that year.

- Compile documentation to support your application. You can either attach the necessary documents for mailing or show original copies to a Social Security employee during an interview.

- Review the information carefully, then sign the form, including your phone number, mailing address, and any other required details.

Start completing your documents online today for a smoother experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Social Security and Supplemental Security Income (SSI) benefits for nearly 69 million Americans will increase 1.6 percent in 2020. Read more about the Social Security Cost-of-Living adjustment for 2020. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $137,700.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.