Loading

Get Fin 405, Casual Remittance Return. Use This Form To Report And Pay Provincial Sales Tax (pst) If

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the FIN 405, Casual Remittance Return. Use This Form To Report And Pay Provincial Sales Tax (PST) If online

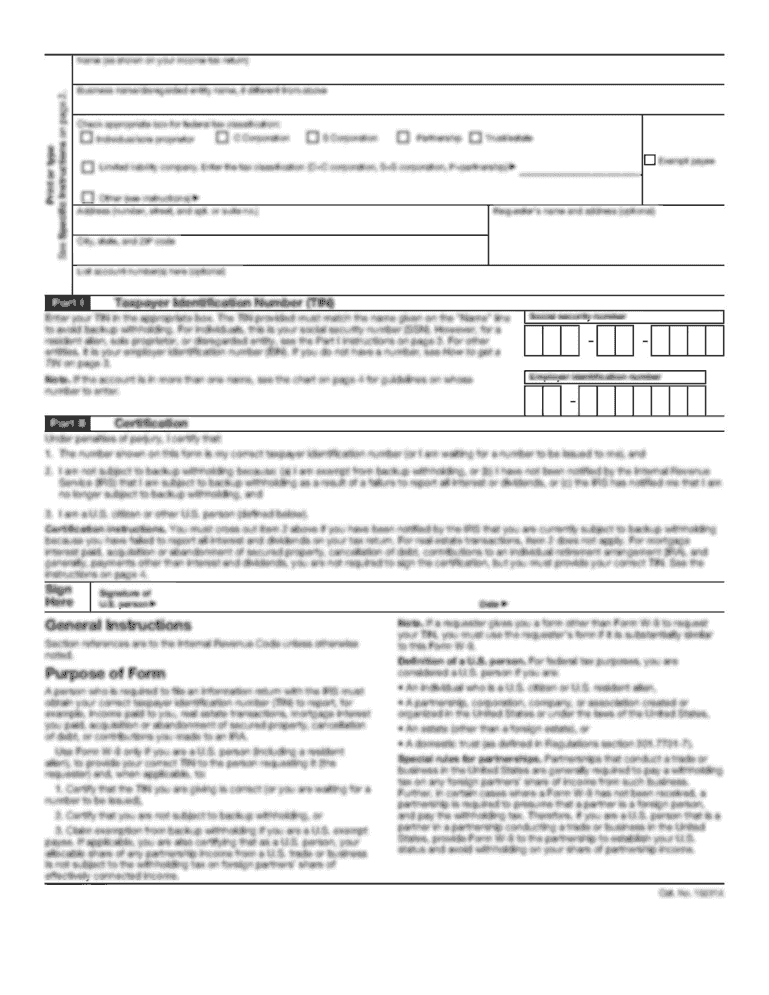

The FIN 405 form is essential for reporting and paying Provincial Sales Tax (PST) for those not registered as PST collectors. This guide will assist you in accurately completing the form online to ensure compliance and ease in processing your remittance.

Follow the steps to successfully fill out the FIN 405 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Part A – Taxpayer Information: Enter your full legal name or the name of your corporation. If you're operating as a partnership, include the names of all partners. Provide your mailing address, ensuring to include street or PO box, city, province, and postal code.

- Part B – PST on Purchases/Leases of Taxable Goods, Software and Services: Indicate whether you are the purchaser or seller by checking the appropriate box. List all taxable goods, software, or services for which tax has not been paid. Include pertinent details such as the purchase/sale date, a description of the item, purchase/lease price, PST rate, and PST due.

- Ensure to attach copies of original receipts or invoices if available. This includes purchase agreements for businesses and lease agreements for equipment.

- Part C – Certification: Certify that the information is true and accurate by entering the full name of the individual completing the form, their title (if applicable), and signing the document. Provide a contact telephone number and the date signed.

- Review all entered information carefully for accuracy. Save any changes made, and ensure to keep a copy for your records.

- Submit the completed form online or print it to mail it to the designated address provided in the instructions.

Complete your FIN 405 form online today to ensure timely remittance of your Provincial Sales Tax.

PST is a 6 per cent sales tax that applies to taxable goods and services and insurance contracts consumed or used in Saskatchewan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.