Loading

Get Za Psg Wealth Client Declaration: Section 14 Transfer Out ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZA PSG Wealth Client Declaration: Section 14 Transfer Out online

Filling out the ZA PSG Wealth Client Declaration: Section 14 Transfer Out online can be straightforward when following clear instructions. This guide will help you navigate through each section of the form effectively.

Follow the steps to complete your client declaration

- Click ‘Get Form’ button to obtain the form and open it in the editor.

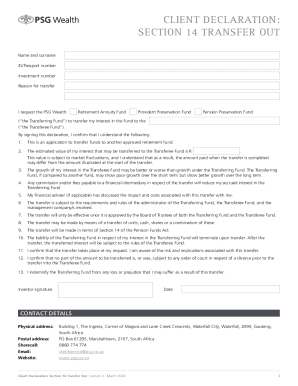

- Enter your name and surname in the designated field. Ensure that the spelling matches your identification documents to avoid any discrepancies.

- Provide your ID or passport number. This information is crucial for verifying your identity during the transfer process.

- Input your investment number. You can find this number on previous documentation related to your investment.

- Select the reason for the transfer. Be honest and precise as this can impact the processing of your application.

- Choose the type of transferring fund from the options provided: Retirement Annuity Fund, Provident Preservation Fund, or Pension Preservation Fund.

- Specify the transferee fund to which you wish to transfer your interest. This is the fund where your investment will be moved.

- Review the declaration statements carefully. Each statement outlines your understanding of the transfer's implications and risks. Ensure that you fully comprehend each point.

- Affix your signature in the designated area to confirm your consent and understanding of the transfer.

- Enter the date of signing. This date is vital for processing your transfer application.

- After completing all fields, verify your entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed form.

Complete your ZA PSG Wealth Client Declaration online to ensure a smooth transfer process.

Benefits may be transferred from any approved pension or provident fund on the member's resignation, retrenchment or dismissal from employment or on the winding up of the employer's fund (referred to in this article as the previous fund). Benefits may not be transferred into a preservation fund when the member retires.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.