Get Indiana Form Wh 4 Instructions Forms.in.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indiana Form Wh 4 Instructions Forms.in.gov online

Filling out the Indiana Form Wh 4 can seem overwhelming, but this guide aims to simplify the process. Follow these clear instructions to help ensure you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to acquire the form and open it in the editor for online completion.

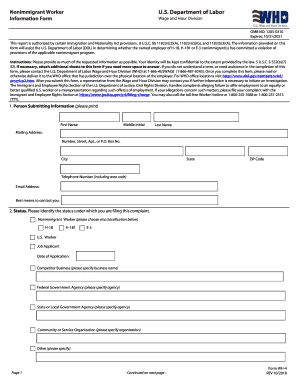

- Begin by providing your personal information in Section 1. This includes your first name, middle initial, last name, mailing address (number, street, apartment, or P.O. box), city, state, ZIP code, telephone number with area code, and email address. Make sure to include your best means of contact.

- In Section 2, indicate your current status by selecting the appropriate option. Choose from Nonimmigrant Worker, U.S. Worker, Job Applicant, or other specified categories. If selecting Nonimmigrant Worker, please specify your visa classification (H-1B, H-1B1, or E-3).

- Section 3 requires information about the company or entity involved in the alleged violation. Provide the name, address, and contact information of the company. If applicable, indicate your dates of employment and job title.

- In Section 4, check all the applicable boxes that describe the alleged violations. Familiarize yourself with each option to ensure you accurately represent the circumstances.

- For Section 5, enter the dates when the alleged violations occurred. If section 6 applies, provide the relevant Labor Condition Application (LCA) numbers.

- In Section 7, describe the location of the worksite(s) where the alleged violations happened. Include complete addresses as necessary.

- Section 8 asks for a description of how you know about the alleged violations. Provide as much detail as possible for each checked item in Section 4.

- Finally, review your entries for accuracy and completeness. After ensuring all information is correct, you can save changes, download, print, or share the completed form as needed.

Complete your Indiana Form Wh 4 online today to ensure a smooth submission process.

For one thing, most employees need to complete a Federal Form W-4, but not everyone needs to complete a state Form W-4. In addition, a Federal Form W-4 tells you how much Federal income tax to withhold from each employee's pay. A state Form W-4 tells you how much state income tax to withhold.

Fill Indiana Form Wh 4 Instructions Forms.in.gov

Register and file this tax online via INTIME. This form is for the employer's records. Do not send this form to the Department of Revenue. Learn how to register and file withholding taxes, and other related information through the Indiana Department of Revenue. Enter your 2-digit county code and the amount of county tax to be withheld from each annuity or pension payment. Consider completing a new Form W-4 each year. In addition, withholding is not required if the employee provides a properly completed Form WH-. Discover essential forms for individual income tax in 2023. Find the proper forms for Full-Year, and Part-Year residents and nonresidents. Print or type your full name, social security number and home address on the appropriate lines of the Form WH-4.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.