Get Wy Ets 101 2000

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WY ETS 101 online

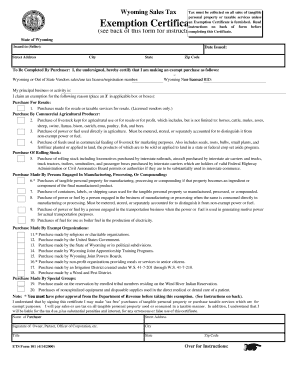

The WY ETS 101 form is essential for individuals or businesses seeking to make tax-exempt purchases in Wyoming. This guide provides a detailed, step-by-step approach to filling out the WY ETS 101 online, ensuring that you understand each component of the form.

Follow the steps to complete the WY ETS 101 form accurately

- Click 'Get Form' button to access the WY ETS 101 online. You will be able to view the form and begin the filling process.

- In the section labeled 'Issued to (Seller):', provide the name and street address of the seller. This identification is crucial for the seller to verify the exemption.

- Fill in the 'Date Issued' field to indicate when the form is being completed. This helps establish the timeline for the exemption claim.

- Complete the city, state, and zip code fields related to the seller's address. Ensure all information is accurate to prevent future discrepancies.

- In the 'To Be Completed By Purchaser' section, the purchaser must certify their exempt purchase by checking the appropriate box or boxes indicating the nature of the purchase—such as for resale or for agricultural use.

- If applicable, include the Wyoming or out-of-state vendor's sales/use tax license or registration number. If the purchaser does not have these licenses, leave this field blank.

- The purchaser must indicate their principal business or activity. This context provides a clear reason for the exemption claim.

- Check the relevant boxes under the exemption reasons. Options include purchases for resale, purchases by commercial agricultural producers, and purchases made by exempt organizations. Make sure to read each description carefully.

- In the final section, fill in the name of the purchaser and their street address. It is important that this information is accurate and matches records on file.

- Have the form signed by an authorized individual, such as an owner, partner, or officer of the corporation. This signature is required to validate the exemption certification.

- Once the form is completed accurately, the purchaser can save changes, download the document, print a hard copy, or share it as needed.

Ensure you complete your exemption certificate online correctly today to facilitate your tax-exempt purchases.

Get form

To obtain a sales tax ID in Wyoming, you must first register your business with the Wyoming Department of Revenue. You can complete this process online through the department's website or by visiting a local office. This registration allows your business to collect and remit sales tax, which is essential for legal compliance. For instructions and support, refer to the information available in WY ETS 101.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.