Loading

Get Uk Hmrc Iht400 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC IHT400 online

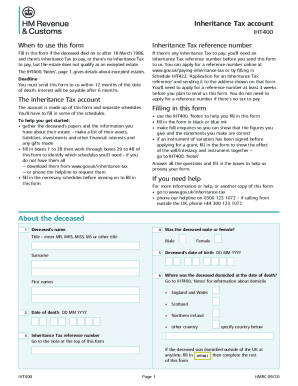

Filing the Inheritance Tax account form IHT400 is an important step that ensures the deceased's estate is properly assessed for tax obligations. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete your IHT400 form online.

- Press the ‘Get Form’ button to access the IHT400 form and open it in your digital workspace.

- Begin by gathering all necessary documents related to the deceased’s estate, including financial records, asset lists, and any gifts made prior to their passing. This will help ensure you have all information at hand.

- Fill in boxes 1 to 28 of the IHT400 form. Pay close attention to details such as the deceased's name, date of death, and domicile.

- Work through boxes 29 to 48 to identify which additional schedules you may need to complete. If required schedules are not already available, you can download them from the official website or request them via the helpline.

- Complete the necessary schedules before returning to the IHT400 form. Make sure all entries are filled correctly using black or blue ink if handwritten or ensuring accuracy in the digital entry.

- Make thorough enquiries to ensure that all figures provided are accurate. If any legal instruments affecting the estate exist, reflect their impact accordingly.

- After completing the main form and schedules, review all entries for accuracy. You can then proceed to save your changes, download a copy for your records, print the completed form, or share it as needed.

Start completing your IHT400 form online today for a smooth inheritance tax process.

Related links form

Fill out and send form IHT400 and form IHT421 to HMRC and wait 20 working days before applying for probate. You normally have to pay at least some of the tax before you'll get probate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.