Loading

Get Tx Tcdrs-70 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX TCDRS-70 online

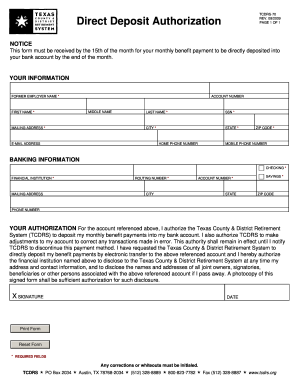

The TX TCDRS-70 form is crucial for authorizing direct deposit of your retirement benefits. This guide will help you navigate the online process of completing the form with clear, step-by-step instructions.

Follow the steps to complete the TX TCDRS-70 online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by filling out your personal information section. Provide your former employer's name, full name, Social Security Number (SSN), and mailing address. Ensure that all starred (*) fields are completed accurately.

- In the banking information section, choose whether you want to set up direct deposit for a checking or savings account by marking the respective field. Enter your banking details including the account number, routing number, financial institution name, and address.

- You must sign the authorization section approving TCDRS to deposit your benefits into your selected account. Also, authorize necessary adjustments for any potential transaction errors.

- After verifying all the information is correct, you can save your changes. Options to download, print, or share the form will be available, enabling you to complete the submission process effectively.

Complete your TX TCDRS-70 form online today for seamless direct deposit of your retirement benefits.

TCDRS and 401k plans serve different retirement purposes. The TX TCDRS-70 is a defined benefit plan mainly for public employees, while 401k plans are defined contribution plans available in the private sector. Knowing these distinctions can help you plan effectively for your retirement goals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.