Loading

Get Za Sars Vat101 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZA SARS VAT101 online

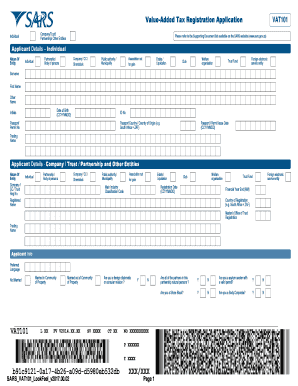

This guide provides a clear and supportive approach to completing the ZA SARS VAT101 form online for value-added tax registration. It is designed to assist users of all backgrounds, ensuring understanding of each component of the form and making the process as seamless as possible.

Follow the steps to fill out the ZA SARS VAT101 online accurately.

- Click the 'Get Form' button to access the VAT101 form and open it in the online editor.

- Begin by filling out the applicant details section. Depending on your entity type, select whether you are an individual, company, trust, partnership, or another entity from the provided options.

- If applying as an individual, input your surname, first name, date of birth, ID number, and passport details if applicable. Make sure to include your trading name.

- For entities such as companies or trusts, enter the registered name, registration number, and main industry classification code. Also, include the financial year end and the country of registration.

- Next, complete the contact details section. You will provide phone numbers, email, and your physical and postal address. Ensure postal addresses are noted accurately and mark if they are the same.

- In the particulars of the representative taxpayer section, fill in the required information about the representative, including their capacity, ID details, and appointment date.

- If applicable, provide the particulars of members, trustees, beneficiaries, or partners. Confirm if each party is a natural person and include their details.

- Input your bank account information. Specify whether the account is in your name or a third party, and complete the bank account details such as account number and bank name.

- Fill out the VAT liability date and business activity code. Indicate whether taxable supplies exceeded the required amounts in the preceding or expected future 12 months.

- Review the VAT registration options and select any applicable diesel refund concessions. Complete your estimated turnover for the current financial year.

- Finally, read and agree to the declaration by signing electronically, confirming that the information provided is true and correct.

- Once you have filled in all required fields, you can save your changes, download the form, and print it for your records or share as necessary.

Complete your ZA SARS VAT101 form online today to ensure timely registration.

Related links form

A copy of a valid identity document, drivers licence, passport, temporary identity document, including the original identification of the appointed person (for those visiting a SARS office); A copy of a valid identity document, drivers licence, passport, temporary identity document of the parent or legal guardian.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.