Loading

Get Irs 8615 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8615 online

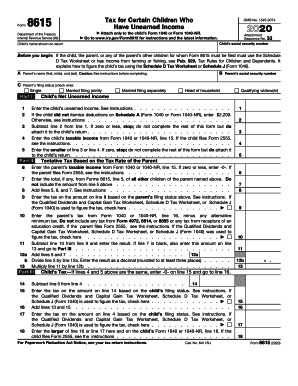

The IRS Form 8615 is used to calculate the tax for certain children who have unearned income. This guide provides clear, step-by-step instructions for filling out the form online, ensuring that users understand each section and field of the document.

Follow the steps to complete the IRS 8615 form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the child's name exactly as it appears on their tax return in the designated field.

- Input the child's social security number in the appropriate section.

- Provide the parent's name, including the first name, initial, and last name.

- Select the parent's filing status by checking the correct box (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)).

- Enter the child's total unearned income in the section labeled for that purpose.

- If the child did not itemize deductions, enter $2,200; otherwise, follow the guidance provided in the instructions.

- Calculate the child's net unearned income by subtracting line 2 from line 1; if the result is zero or less, stop and attach the form to the child's return.

- Input the child's taxable income from Form 1040 or 1040-NR, line 15.

- Determine the smaller value between line 3 and line 4 and record it accordingly.

- For Part II, enter the parent's taxable income from Form 1040 or 1040-NR, line 15.

- Input the total amount from all other children’s Forms 8615 if applicable.

- Add lines 5, 6, and 7 according to the instructions.

- Calculate the tax based on the amount in line 8 using the parent's filing status as a reference.

- Continue through the form, ensuring all information is accurately provided, and follow through Part III to finalize calculations.

- Once all sections are completed, save changes, and download the form for submission.

Complete your IRS 8615 form online today for efficient tax reporting!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

File Form 8949 with the Schedule D for the return you are filing. This includes Schedule D of Forms 1040, 1040-SR, 1041, 1065, 8865, 1120, 1120-S, 1120-C, 1120-F, 1120-FSC, 1120-H, 1120-IC-DISC, 1120-L, 1120-ND, 1120-PC, 1120-POL, 1120-REIT, 1120-RIC, and 1120-SF; and certain Forms 990-T.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.