Get Or Das-rm 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR DAS-RM online

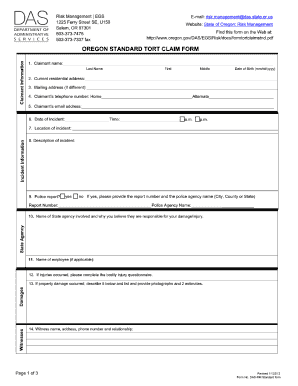

Filling out the Oregon Standard Tort Claim Form (OR DAS-RM) is a crucial step for individuals seeking to report an incident and pursue claims for damages or injuries. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately and effectively.

Follow the steps to complete your OR DAS-RM online.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Enter your claimant information. In the section labeled 'Claimant Information,' provide your last name, first name, and middle name. Also, include your date of birth.

- Fill out your current residential address, and if it's different, also provide a mailing address.

- Input your contact details by providing your phone number (both home and an alternate number) and your email address.

- Document the date and time of the incident and indicate whether it occurred in the morning (a.m.) or evening (p.m.).

- Specify the location and provide a detailed description of the incident to give context to your claim.

- If a police report was made, indicate 'yes' or 'no.' If 'yes,' provide the report number and the name of the police agency.

- Identify the state agency involved and explain why you believe they hold responsibility for your damage or injury.

- If applicable, provide the name of the employee connected to the incident.

- Complete the bodily injury questionnaire thoroughly, providing details such as your injuries, medical expenses, and any future treatment expected.

- Should there be property damage, describe the damage thoroughly and include any related photographs and estimates.

- Gather witness information, including their names, addresses, phone numbers, and their relationship to you or the incident.

- Once every section is filled out accurately, review the form to ensure all information is correct.

- Save changes to the document, and then you can download, print, or share the completed form as needed.

Complete your OR DAS-RM online today to ensure your claim is processed timely and efficiently.

Get form

If you receive a 1099 for a deceased person, you must report that income on their tax return or consider it for the estate's tax implications. Ensure to check with the issuer for proper handling, as these documents are critical for accurately reporting income. It’s important to clarify any questions with a tax professional. OR DAS-RM provides resources to help you manage such situations effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.