Loading

Get Refinance Mortgage Calculator

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Refinance Mortgage Calculator online

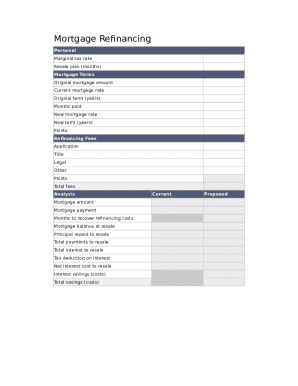

Refinancing your mortgage can be a significant financial decision, and using a Refinance Mortgage Calculator can help you evaluate your options effectively. This guide provides clear and structured instructions to assist you in completing the calculator online.

Follow the steps to accurately complete the Refinance Mortgage Calculator.

- Click the ‘Get Form’ button to access the Refinance Mortgage Calculator and open it in your preferred browser.

- Enter your personal information, including your marginal tax rate and your resale plan in months. This data helps in understanding the potential tax implications and timing of your property's potential resale.

- Input the details regarding your current mortgage, such as the original mortgage amount, current mortgage rate, original term in years, and the number of months already paid. Make sure to verify these figures to obtain an accurate calculation.

- Provide the updated mortgage details by specifying the new mortgage rate and the new term in years. Additionally, indicate any points you anticipate paying and associated refinancing fees.

- Review all components of your current and proposed mortgages, including total fees and the analysis section. This will include mortgage amounts, payments, months to recover refinancing costs, and various other financial metrics related to your refinancing.

- Once all fields are filled, check your entries for accuracy. After confirming that everything is correct, you can choose to save your changes, download, print, or share the completed form.

Begin exploring your refinancing options by completing the Refinance Mortgage Calculator online today.

Many experts often say refinancing isn't worth it unless you drop your interest rate by at least 0.50% to 1%. ... A large loan size may result in significant monthly savings for a borrower, even when rates dip by only 0.25 percent, says Reischer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.