Loading

Get Asset Depreciation Schedule

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Asset Depreciation Schedule online

Completing the Asset Depreciation Schedule online can streamline your record-keeping and help in accurately assessing your asset management. This guide offers straightforward steps to ensure you fill out the schedule correctly and with confidence.

Follow the steps to successfully complete the Asset Depreciation Schedule.

- Click ‘Get Form’ button to access the Asset Depreciation Schedule and open it in your preferred online editor.

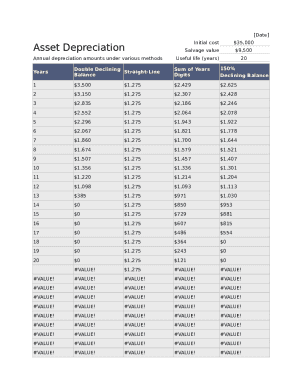

- Enter the initial cost of the asset in the designated field. This amount represents the total purchase price, which in this example is $35,000.

- Next, fill in the estimated salvage value, which is the expected residual value of the asset at the end of its useful life. The salvage value for this example is $9,500.

- Indicate the useful life of the asset in years. In our example, this is set to 20 years.

- For each year of the asset’s life, choose the depreciation method to apply: Double Declining, Straight-Line, Balance, or Sum of Years Digits. Enter the corresponding annual depreciation for each year, based on the listed calculations.

- Review your entries for accuracy, ensuring all fields are filled out according to the provided data. It is crucial to double-check for any entry errors.

- Once you have completed the form, save your changes, and consider downloading or printing it for your records.

Start filling out the Asset Depreciation Schedule online today for organized and efficient asset management.

Class life is the number of years over which an asset can be depreciated. The tax law has defined a specific class life for each type of asset. Real Property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. See Publication 946, How to Depreciate Property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.