Loading

Get Expense Budget Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Expense Budget Template online

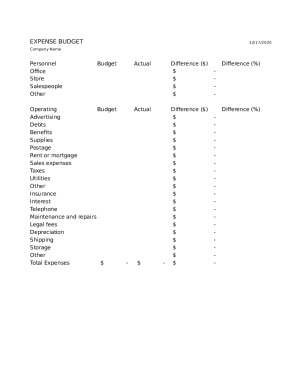

This guide provides a step-by-step approach to accurately fill out the Expense Budget Template online. By following these instructions, users will be able to ensure all relevant financial data is captured effectively.

Follow the steps to complete your Expense Budget Template.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the 'Company Name' at the top of the template. This should reflect the name of your organization for which the budget is being created.

- In the 'Personnel' section, designate the various categories such as Office, Store, Salespeople, and Other. Enter the anticipated costs associated with each category.

- Next, move to the 'Budget' section. Here, you will input projections for various expenses, including Operating Budget, Advertising, Debts, Benefits, Supplies, and more. Ensure to fill each applicable field with accurate financial figures.

- Review the 'Total Expenses' field at the bottom of the budget section. This should auto-calculate based on the figures entered in the previous expense categories. Confirm that the total aligns with your anticipated expenditures.

- In the 'Actual' section, input the actual expenses once incurred. This will allow for a comparison against your budgeted amounts.

- Review the Difference ($) fields, which will show the variance between your budgeted and actual expenses. This is useful for financial analysis.

- Lastly, check the Difference (%) fields where the variance is represented as a percentage. This can help in assessing the performance relative to the budget.

- Once all relevant fields are completed, you have the option to save changes, download, print, or share the completed form depending on your needs.

Start completing your Expense Budget Template online today to keep your finances organized!

Step 1: List monthly income. Step 2: List fixed expenses. Step 3: List variable expenses. Step 4: Consider the model budget. Step 5: Budget for wants. Step 6: Trim your expenses. Step 7: Budget for credit card debt. Step 8: Budget for student loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.