Loading

Get Projected Balance Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Projected Balance Sheet online

Creating an accurate projected balance sheet is crucial for financial planning and analysis. This guide provides a step-by-step approach to filling out the Projected Balance Sheet online, ensuring that you can present your financial forecasts clearly and effectively.

Follow the steps to complete your Projected Balance Sheet effortlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

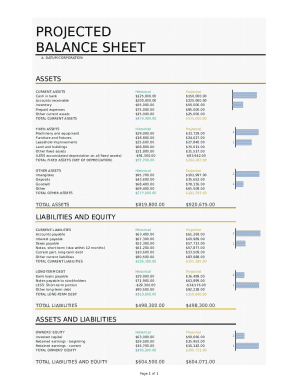

- Begin by entering your current assets. You will need to list the amounts for cash in bank, accounts receivable, inventory, prepaid expenses, and other current assets. Ensure that the total current assets reflect the sum of these entries.

- Next, move to the fixed assets section. Input values for machinery and equipment, furniture and fixtures, leasehold improvements, land and buildings, and other fixed assets. Subtract the accumulated depreciation from the total to get the net fixed assets value.

- Proceed to the other assets category. Record amounts for intangibles, deposits, goodwill, and any other assets you may have. The total of this section should encompass all entries.

- Calculate the total assets by adding the total current assets, net fixed assets, and total other assets. This should reflect the overall projected worth of the organization.

- Now, transition to the current liabilities area. Document the figures for accounts payable, interest payable, taxes payable, short-term notes, current portions of long-term debt, and other current liabilities to find the total current liabilities.

- Fill out the long-term debt section. Enter your bank loans, notes payable to stockholders, subtract the short-term portion, and include any other long-term debts to determine your total long-term debt.

- Calculate the total liabilities by summing both the total current liabilities and total long-term debt you've previously documented.

- In the owners' equity section, report the invested capital and retained earnings (both beginning and current). Total these amounts to find the total owners' equity.

- Finally, confirm that the total liabilities and equity align with the total assets you calculated earlier. Once everything is accurately filled in, you can save your changes, download, print, or share the completed Projected Balance Sheet.

Start filling out your Projected Balance Sheet online today to ensure your financial planning is accurate.

To create a projected income statement, it's important to take into account revenues, cost of goods sold, gross profit, and operating expenses. Using the equation gross profit - operating expenses = net income, you can estimate your projected income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.