Loading

Get Security Professionals Expense

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Security Professionals Expense online

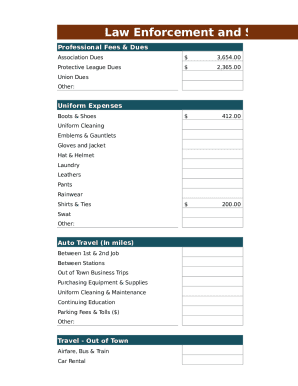

The Security Professionals Expense form is essential for documenting and claiming various professional expenses related to security work. This guide provides clear instructions on how to complete the form accurately and efficiently, ensuring you capture all relevant expenses.

Follow the steps to successfully complete the Security Professionals Expense form.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your association dues. This includes fees associated with professional memberships. Ensure you accurately list all relevant dues.

- Proceed to document uniform expenses. Clearly state costs related to purchases such as boots, uniforms, and specific cleaning expenses. Accurately categorize each item for clarity.

- Input your auto travel expenses. Include mileage for travel between jobs, various stations, and any out-of-town business trips.

- Complete the section for equipment and supplies. List all necessary purchases related to your role in security, including repairs and maintenance costs.

- Fill out the travel expenses section. Detail costs for airfare, lodging, and any other travel-related fees that are pertinent.

- Sum all miscellaneous expenses, including insurance costs and any legal fees associated with your professional duties.

- Review all sections for accuracy before finalizing your entries.

- After confirming that all information is correct, save your changes. You may also have the option to download, print, or share the form as needed.

Complete your Security Professionals Expense form online today to ensure timely processing of your claims.

Section 179 of the TCJA allows businesses to deduct the cost of fire and security systems, and other equipment, up to a total of $1,050,000 in 2021. The TCJA allows businesses to deduct equipment expenses up to $1,050,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.